That’s how much one bitcoin traded for on March 18, 2016.

If you’re a longtime Palm Beach Letter or Palm Beach Confidential subscriber, you’ll recognize the date.

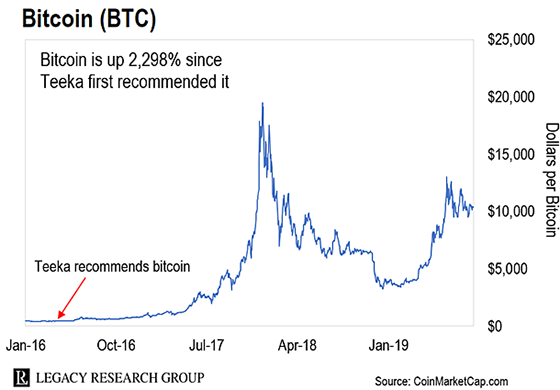

That’s when world-renowned cryptocurrency investing expert Teeka Tiwari first recommended you buy bitcoin.

By December 2017, the world’s first cryptocurrency had shot up to an all-time high of $20,089.

And at writing, bitcoin trades for $10,263. That’s a 2,298% gain from when Teeka added it to the model portfolio.

The stars are aligning for bitcoin to take out its all-time high.

In fact, Teeka believes it’s going a lot higher than that in our lifetimes.

As you’ll see in today’s dispatch, three drivers are pushing bitcoin higher.

First, to borrow a phrase from Legacy Research cofounder Bill Bonner, bitcoin is “honest money.” Second, bitcoin is your “escape hatch” in the War on Cash. Third, Wall Street is getting on board.

It’s why, if you haven’t already, we recommend you take a small stake in bitcoin. It can be as little as $100. The important thing, if you want to capture the gains that are still ahead, is you get your feet wet.

And if you already own bitcoin, you’ll want to check out the five “altcoins” (cryptos other than bitcoin) Teeka says could turn $500 into $5 million. He’s hosting his first live crypto training session of 2019 all about it tomorrow at 8 p.m. ET.

Already, more than 40,000 Legacy Research readers have signed up to attend. Find out how you can join them and Teeka for free here.

Meantime, let’s look at each of those three drivers sending bitcoin higher.

Unlike the dollar, the euro, the yen, and other government-issued currencies… bitcoin isn’t subject to the whims of politicians and central bankers.

Take the U.S. dollar. Dollars used to be backed by gold. But since President Nixon cut off the dollar’s last ties to gold in 1971, Uncle Sam can create as many new dollars as he likes. All it takes is a few strokes on a computer keyboard at the Fed (America’s central bank).

Bitcoin, on the other hand, is a hard currency like gold. The total supply is capped at 21 million. And it costs time and resources to “mine,” or create, each new coin.

According to digital trends research firm Digiconomist, bitcoin consumes about 73 terawatt-hours a year.

That’s more than the energy consumption of Austria, a country of 8.7 million people.

Why does the bitcoin network require so much power?

Bitcoin “miners” have to first solve a complex math puzzle to earn newly created coins. This involves intense computer processing power… which requires a lot of electricity.

A lot of folks see this as a “bug” of the bitcoin algorithm. But it’s actually one of its most important features.

As Bill has been telling his readers, it’s what separates it from the phony currencies governments issue…

Fake money is a form of fake news. It tells you something that isn’t true. Money that is not anchored in the real world of time and resources is unreliable. Like all forms of fake information, it leads to mistakes, frauds, bad investments, wrong decisions, and corruption that destroy wealth and disrupts the basic fairness of our financial transactions.

And as Teeka made clear last Tuesday in these pages, bitcoin’s reliability is only going to be more valuable as faith in government-issued currencies ebbs.

We spilled a lot of ink last week on governments’ push to create a cashless society. (Catch up here and here.)

Governments can’t track cash transactions. Cash also makes it hard for central banks to hit savers with negative rates. You can just withdraw your cash from the bank and stuff it under the mattress.

But as currency expert Jim Rickards warns, when all your money is digital, you’re herded into a digital pen… like a pig to the slaughter.

Last month, China’s central bank said it’s close to launching its own digital-only version of the renminbi, the Chinese national currency.

And as we showed you last Thursday, it’s not the only country getting rid of physical cash. Plans are afoot in Canada, Britain, Norway, and Sweden to launch digital-only national currencies.

It won’t be long before the U.S. also replaces the system we have today with a purely digital “e-dollar.”

You’ll be able to send, receive, and store it through an app on your phone. And it’ll exist on a “blockchain” – the secure digital ledger technology that records all bitcoin transactions.

But although they’ll share some technological similarities, e-dollars won’t be honest money.

The Fed will still be able to issue as many e-dollars as it likes. It will also still be able to hit e-dollars with negative rates… and whatever crackpot ideas it comes up with next to “stimulate” economic growth.

Worse, these new crypto-fiat hybrids will allow governments to track and monitor every transaction you make. That makes the digital surveillance state we’ve been warning you about one step closer to reality.

Folks on Wall Street have one thing in common. They’re all driven by greed.

It’s the third factor that will drive bitcoin back to $20,000 and beyond.

That’s the big call Teeka made at the start of the year. As he put it at the time, as Wall Street started building the infrastructure to bring professional investors into the crypto market, a rush of new money would send bitcoin and other cryptos soaring.

And we’re seeing that happen now. Teeka…

Last month, Bakkt received regulatory approval to begin trading physically settled bitcoin futures. Bakkt is a subsidiary of the same company that owns the New York Stock Exchange. Its platform is set to go live this coming Monday. It’ll buy bitcoins on the open market and store them on behalf of customers. That’s never happened before.

Also, the CEO of crypto exchange Coinbase, Brian Armstrong, said institutional customers are now depositing between $200 million and $400 million in crypto per week to its new Coinbase Custody product. Since July 2018, Coinbase Custody has amassed more than $1 billion in controlled assets.

And earlier this month, VanEck Securities and SolidX Management announced their plan to launch a bitcoin fund for institutional buyers – such as banks and pension funds. Since this fund will target only accredited investors, it faces fewer regulatory hurdles.

In short, the smart money is getting ready to reap the profits from another crypto boom. So this may be your last chance to get in before prices really take off again.

That’s the name given to cryptocurrencies other than bitcoin. (It’s short for “alternative coins.”)

And Teeka has a proven track record of picking winners in the altcoin market.

Take his top three open recommendations at Palm Beach Confidential. Even after last year’s “Crypto Winter” bear market, they’re up 729%… 2,089%… and 7,139% today.

That’s why, tomorrow at 8 p.m. ET, Teeka is hosting a free live crypto training session – “5 Coins to $5 Million.”

He’ll be pulling back the curtain on five tiny cryptos that could make you millions… in as little as 10 months. It’s all thanks to a lucrative phenomenon that we won’t see again until 2024.

Plus, Teeka will give you the name of the top cryptocurrency on his buy list during this free event. Last time Teeka gave away his No. 1 pick, it soared 1,800% in nine weeks.

Find out more… and reserve your spot… here.

As you’ll see, bitcoin is growing up.

As it grows in size, it’s getting a lot less volatile. It still suffers more dramatic swings than stocks. But prices are recovering quicker following the big falls.

Based on this, Teeka expects bitcoin to take out its $20,000 all-time high within the next nine months.

Regards,

|

Chris Lowe

September 17, 2019

Delray Beach, Florida