Stories matter…

In 2001, I landed a job as a trainee analyst at Bloomberg competitor Reuters.

I was 25 years old. And I’ve been thinking and writing about markets ever since.

One of the most important lessons I’ve learned is that stories – not facts, or statistics, or data-driven research – do the most to shape our investment decisions.

They have a sticking power… and an emotional punch… that facts and figures lack. And once we get a story about the market stuck in our head, it’s hard to change our minds.

And that inflexibility can get us in trouble. It can also lead us to miss out on some of the biggest opportunities the markets have to offer.

Right now, the story most folks believe is that we’re headed into a recession and another leg down in the bear market.

And that story could end up being true…

But another lesson I’ve learned over the past two decades is that when everybody buys into the same story, something unexpected usually happens instead.

So today, I encourage you to question the consensus view… and entertain a counter-consensus one instead.

For the next few minutes, let’s empty our heads of stories… and focus instead on the bare-bones facts.

Tech stocks have made a remarkable comeback in 2023…

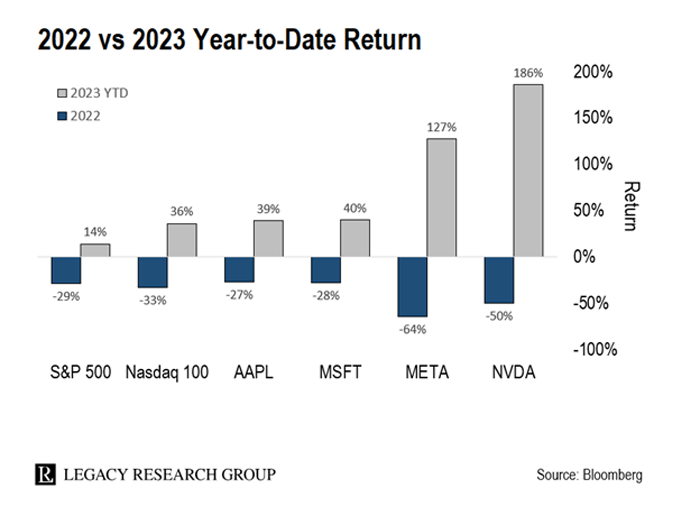

It’s all in this chart…

You’re looking at the returns of the large-cap S&P 500 index versus some of the biggest names in tech. The grey bars are of the returns so far in 2023. The blue bars are returns for 2022.

The S&P 500 is up 14% this year. That’s pretty good. In a typical year, the S&P 500 is up closer to 10%.

But so far this year, Facebook parent company Meta Platforms (META) has surged 127%. Microsoft (MSFT) and Apple (AAPL) are up 40%. And Nvidia (NVDA), which makes advanced semiconductors for gaming, crypto mining, and artificial intelligence (“AI”) systems, is up 186%.

And you didn’t have to pick stocks to take advantage of this boom. The Nasdaq 100 index is packed full of mega-cap tech stocks. It’s up 36%.

Sharp-eyed readers will have spotted a trend…

The biggest gainers – Nvidia, Meta, and Microsoft – are at the forefront of the AI boom.

Meta is adding AI text, image, and video generators to Facebook and Instagram. And Microsoft has integrated ChatGPT into its Bing search engine.

But the most stunning rise is Nvidia’s.

It makes most of the advanced chips that go into AI systems such as ChatGPT. It’s the groundbreaking AI chatbot everybody is talking about.

On May 25, Nvidia’s share price jumped 24% on a blowout earnings forecast. This added $184 billion to its market value… in one day.

That’s enough to buy all of Walt Disney, Wells Fargo, or Verizon. And those are among the biggest blue chips in the world.

The problem with Nvidia is it’s priced for perfection…

As I talk about all a lot in these pages, there’s no such thing as a good or bad stock regardless of price.

You can buy a great business. But if you overpay, you won’t make any money from your investment. It’s basic math: The more you pay to own shares, the lower your profits will be when you go to sell.

And right now, Nvidia is expensive.

Its shares are selling for 47x next year’s expected earnings. Said differently, you pay $47 for every $1 of earnings the company is forecast to make for the year.

That compares with an average price-to-earnings ratio of 37x for rival semiconductor stocks.

That doesn’t mean Nvidia can’t go higher. It’s the Michael Jordan of AI chipmakers.

But at 47x earnings, a lot of that growth is already priced in.

So, how do you play the AI revolution?

It’s a question our new tech investing expert will be answering over at our Bleeding Edge e-letter.

Colin Tedards is taking the reins from Jeff Brown.

Colin has been breaking down the biggest opportunities in tech and beyond for the 125,000 followers of his YouTube channel.

But he didn’t set out to publish investment research.

In 2006, he opened a clothing store. Then in 2008, with the economy in freefall, he had to shut down his business.

That’s when he began to teach himself about investing.

His journey began by watching the talking heads on CNBC. But he soon discovered he only heard about stocks way after their big move.

So, he turned off the TV. And he focused instead on analyzing balance sheets… doing boots-on-the-ground research… and identifying winning management teams.

Colin’s hard work paid off – in spades…

In 2016, he made a 900% return on a once-tiny logistics company.

It was a penny stock when he first bought in. But he saw that a new CEO was taking over who had the experience to transform the business.

The payoff on that single investment funded the purchase of his current home in California.

Then, at the request of friends and family, he started sharing his investment research online so they could follow along.

His first big win was The Joint Corp (JYNT). It runs a network of chiropractic clinics. This recommendation gave his followers the chance to earn a 3,181% return in five years.

He also correctly called rallies in Enphase, Getty Images, and Amazon. And he warned his followers to stay out of Under Armour, Rivian, Intel, and Zoom before major drawdowns.

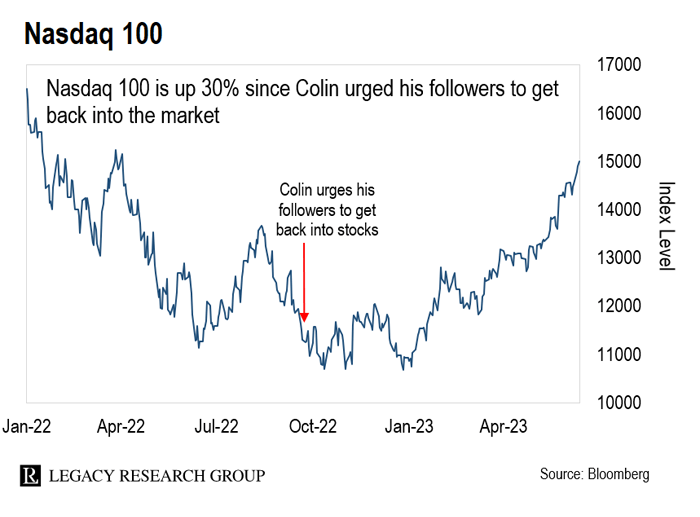

But perhaps his most important call was the one urging his followers to get back into the market in September 2022… just days before the market bottom that October.

And today, Colin remains bullish on stocks, despite the mainstream view that the market is headed for another fall.

That’s because we’re entering a new dot-com era…

That was his message to readers in his first issue at the helm of The Bleeding Edge.

Only this time, it’s not about the rollout of the internet at scale, but about the rollout of AI systems at scale.

This isn’t just a story about Nvidia, Microsoft, and other companies directly involved in AI. Colin says AI will transform the way every business is run…

The AI opportunity is much bigger than a handful of tech companies.

Like how the internet transformed business in the early 2000s… AI will change the way companies operate in the 2020s and beyond.

The CEO of IBM, Arvind Krishna, recently told Bloomberg he sees AI replacing 30% of office jobs over the next five years.

That would boost IBM’s $1.6 billion in profits to $2.4 billion – a 48% jump.

And IBM isn’t alone. Colin again…

The Washington Post, Bloomberg, and CNET are using AI to write articles. They’re also using AI to make their human writers more productive. That means fatter margins and higher profits.

That’s why I’m so excited about AI. As corporate profits rise, share prices and dividends will also grow.

Big tech companies are the early adopters. But we’ll see even sleepy insurance and banking companies adopt AI on a massive scale in the coming years.

Colin is already on the task of finding the first movers with strategies in place to adopt AI.

And he’ll be sharing what he discovers over at The Bleeding Edge.

So, if you’re a Bleeding Edge reader, look out for those in your inbox. And if you’re not already a reader, you can sign up, for free, here.

It’s been one of the most popular e-letters we publish. And under Colin’s stewardship, I expect it will only get even more popular.

I had the pleasure of catching up with him today via Zoom. And he has an infectious enthusiasm for helping folks make money in the stock market that I think you’re going to love.

So, keep your eye on your inbox for more insights from Colin in these pages.

Regards,

|

Chris Lowe

Editor, The Daily Cut