Nothing happens in isolation.

Everything connects.

It’s why we see the work of The Daily Cut to be about “connecting the dots.”

And there are plenty of dots to connect.

We’ll connect several of them for you today.

And we’ll show you exactly how the financial system (Wall Street) is always looking for a way to put one over on regular folks.

So keep reading, but just note…

There’s no stock pick… no action for you to take… and no reveal of a secret to help you make a million dollars without really trying!

But there is a warning. And that warning is to question everything that Wall Street and the financial services industry serve up to you.

Because if they can structure products and investments in the way we show below to screw one group of folks, there’s no question they’ll do the same to you.

More in a moment. But first, a quick rundown of today’s market action…

Market Data

The S&P 500 closed up 1.9% to end the day at 4,495.70… the Nasdaq gained 2.4% to close at 14,094.38.

For individual stocks, Microsoft closed up 1% to $370.27… Apple ended higher by 1.4% at $187.44… and Tesla ended the day at $237.41, a 6.1% gain.

In commodities, West Texas Intermediate crude oil trades at $78.25… gold is $1,967.40 per troy ounce… and bitcoin is $35,320.12.

And now we return to connecting the dots…

Connecting the Dots… and What They Mean

Before we get to our main point, we need to set the scene, by connecting a few dots.

The first of our dots comes from Bloomberg. We showed it to you at the end of yesterday’s Daily Cut. We show it again as part of today’s in-depth essay:

It’s a tough time to sell a mansion in Los Angeles.

The market for the priciest properties in the city faces challenges such as a new tax on luxury sales and turmoil in the entertainment industry. Now, some homeowners are turning to another path to generate cash: Renting them out.

This week, Rob DeSantis listed his seven-bedroom, 12-bath Manhattan Beach waterfront house for rent at $150,000 a month for leases of 90 days or less. The nearly 13,000-square-foot (1,200-square-meter) property is one of five he owns in California, said DeSantis, a serial entrepreneur who co-founded Ariba and was an early investor in LinkedIn Corp.

This DeSantis character (not that DeSantis) seems like a smart guy. So it’s hard to begrudge him any success.

Even so, we wonder how much of the wealth from five California mansions is due to entrepreneurialism, and how much is the consequence of cheap money and artificially high asset prices.

We’ll leave that thought open with no further comment. But it’s just one dot in the chain. And it leads us to our second story, also from Bloomberg:

U.S. debt held by those younger than 50 years old rose to a record in the third quarter, according to Federal Reserve figures.

Consumers under the age of 50 held $9.5 trillion in debt last quarter compared with $9.3 trillion in the second quarter. The increase was the most since the final quarter of 2022.

Overall U.S. household debt grew by $228 billion last quarter to reach $17.3 trillion. The increase was driven by consumers younger than 50, as borrowing by older Americans was little changed. The debt level for those over 50 peaked in the first quarter.

Another dot.

This time, it’s news that consumers under the age of 50 hold $9.5 trillion in debt. But it’s just one more dot.

No conclusions yet. We continue.

Next, heading back to California, this time from the Los Angeles Times:

Homelessness continues to rise dramatically, increasing by 9% in Los Angeles County and 10% in the city of Los Angeles last year, a stark illustration of the challenges faced by officials trying to reduce the number of people living on the streets.

The report on LA homelessness was actually from earlier this year. It’s unlikely that things have improved since.

According to the volunteers who track the numbers, they estimate more than 75,000 people were classified as homeless in the LA county area.

For context, the population of Santa Monica, California, is around 91,000. The population of Green Bay, Wisconsin, is around 100,000.

The population of Albany, New York, was around 98,000 at the last census.

And, again, the homeless population in LA County alone is more than 75,000.

Let’s now connect the dots…

Billionaire renting out LA mansion for $150,000 per month… under 50s owing more than $9.5 trillion in debt… LA county homelessness running at the equivalent of the population of a small American city or municipal area.

Can all these outcomes truly be unrelated?

Well, perhaps there isn’t a direct relationship.

But it’s not hard to see a close indirect relationship between these situations and the actions of the government, Treasury, and Federal Reserve over the past 15 years.

This brings us to our next “dot.” And it’s the key to understanding how these dots tie together…

Securitizing Poverty

It neatly packages elements of each of the previous stories into one bundle – a “securitization of poverty” if you like (we’ll explain what we mean by that shortly).

The headline from Bloomberg sets the scene, “How Wall Street Makes Millions Selling Car Loans Customers Can’t Repay.”

The story explains the basics. We’ll add a little more color as we move on:

If many of these subprime borrowers couldn’t repay, it hardly mattered to investors. Multiple layers of protections all but guaranteed that they’d get back their principal with interest. While customers would often lose their cars to repossession and have their lives upended, Santander stood to earn tens, if not, hundreds of millions of dollars.

[…]

As is typical for bonds backed by risky car loans, a Santander offering document suggests it built the security based on the assumption that much of the debt would go bad. The company initially projected that customers would fail to repay 42% of the money they borrowed. Thousands of borrowers would ultimately default. Even some in the industry question whether it makes sense to let so many customers take on more debt than they can afford. ‘It doesn’t really work for the consumer,’ says Daniel Chu, chief executive officer of subprime auto lender Tricolor Holdings. ‘But it works for everyone else.

For anything that any consumer buys, the term caveat emptor applies (buyer beware).

And yet, when you see a story like this… and you note the fact that the story tells us investors are “guaranteed” a return on a high-risk asset… where 42% of payments will default… you know something isn’t quite right.

The sad thing is that it’s all there in plain sight.

It just requires some thinking. We’ll work through that thinking with you today.

What you’ll come to understand is that it’s another case of Wall Street reverse-engineering a financial product to suit its needs.

So, what do we mean by that?

Here’s how it works:

Wall Street starts with the premise they need to generate a fee. They then work backward to design a strategy to generate that fee.

That means this isn’t about the riskiness of the customer. It’s about charging a high interest rate that results in the borrower paying as much as possible as quickly as possible.

The more money they can receive through a high interest rate – and quickly – the greater the overall return.

42 Cents on the Dollar Will Go Unpaid

That’s the only possible explanation. Especially when the Bloomberg story tells us the lender forecasts non-repayment of 42% of the money borrowed.

But it’s important to note that doesn’t mean the lender loses out… even though the borrower won’t repay 42 cents on each dollar borrowed.

When these firms charge interest rates of 20-30%, they only need the average borrower to keep up repayments for a year or two (possibly less)… even if the loan term is five or seven years.

That’s because, in the early part of any loan, the borrower is paying more interest than principal (the principal being the dollar amount borrowed).

For example, take a $50,000 auto loan at an interest rate of 25%.

After two years, the interest on that loan amounts to $24,000. Yet, they’ve only repaid $7,000 of the loan’s principal amount.

So, after making $31,000 in payments ($24,000 in interest, and $7,000 principal), the loan outstanding is still $43,000… after two years.

Bad news for the borrower. But for the lender, this is another important part of the math.

Because if the borrower defaults and the lender has to repossess the car, there’s almost zero chance the lender loses money.

Even if the car’s value has fallen to (say) $40,000, the lender still won’t lose.

The lender will either take action to recover the money, or they’ll likely sell the loan to a collections firm for 10 cents on the dollar… leaving the collections firm to recover the rest.

As we mentioned above, caveat emptor – buyer beware.

Even so, there’s something wrong with a financial product that is designed for failure.

And it is designed for failure. Lenders know their customers won’t meet their payments. So it’s better to get the money quick, repossess the car before it gets any older, and move on to the next sucker.

That’s why, despite subprime borrowers having bad credit, Wall Street loves the returns they can make from them.

Think of it this way. If they only lend to prime borrowers, they will charge a lower interest rate because they have a lower risk of default.

As a lender, that’s good, right? Sure. But the lender faces a different type of risk – early repayment risk. That is, prime borrowers are more likely to repay a loan early.

If enough borrowers do that, the investor doesn’t get the longer-term income stream overall, or a higher yield, because the borrowers aren’t paying as much interest.

Instead of paying 7% interest over a five-year loan, maybe the borrowers only pay that over three years, because they’ve repaid early. In interest terms, instead of the lender receiving $9,000 in interest, they only get $8,000 in interest.

Perhaps not a big deal in isolation. But multiply that over thousands of securitized loans and it has an impact.

But if they can bolster these securitized loans with subprime loans… jack up the interest rate on those borrowers… collect as much interest as soon as possible… it provides a nice return. Even if it’s not in the borrower’s best interest.

Pre-Destined to Lose by Design

It’s hard to think of any other investment type where one side of the ledger is pre-destined to lose by design.

This isn’t like a regular stock or bond investment, where it’s a win-win-win relationship.

When you invest, the investor gets the chance of a return. And the company that received the capital or loan has the opportunity to invest those funds for the benefit of the company, investors, and its customers.

But this “securitized poverty” is a win-win-lose relationship. Wall Street wins. The lenders win… even the auto dealership wins. But the customer loses. All by design.

It’s why to our mind, this is simply a case of Wall Street securitizing poverty.

Now, will any of this cause a market crash? No.

This isn’t like the subprime mortgage disaster. For the simple reason that cars are mobile. If the lender can’t sell a repossessed car in the Florida market, they can ship it to Ohio or Nevada or anywhere else.

Unlike a house, of course, which is in a fixed location.

We also know that many folks, maybe even you, will say these borrowers only have themselves to blame. That it’s greed… that they should know better.

Perhaps. We’ve noted the “buyer beware” saying a couple of times today.

The best we can offer in return is that when something stinks, you can either hold your nose and ignore it… or you can point it out… connect the dots, and let you, our reader, make up your own mind.

Look, these situations won’t break the market on their own.

But they’re yet another example of how manipulated markets continue to create an environment where Wall Street wins and almost everyone else loses.

And eventually, that will cause something to break. Maybe in markets, maybe elsewhere in society.

“More of an Impact on Your Wealth than Anything… We’ve Ever Seen Before”

On the subject of money, Teeka Tiwari recently recorded a terrific video where he talks about the value of money and the government’s control of money.

It’s a subject closely related to the nature of today’s essay. Here’s what Teeka said to his Palm Beach Letter subscribers:

You must be prepared for the changes that are taking place in our country. We’re in the process of undergoing a series of changes that will have more of an impact on your wealth than anything I think we’ve ever seen before… Because the government is going after the very nature of money, the very sanctity of money.

What I mean is we’ve always been able to hold our own money with dollars in our hands or our bank account and it was ours. That’s going to change. The government is going to put itself in between us and our money and essentially determine what we can spend our money on.

The way that any technology − whether it’s used for good or bad – unfolds, first, it’s just an idea. Then, it rolls out slowly. Then, people think, ‘Oh no, that could never happen.’ And then, all of a sudden, it’s everywhere all at once.

Second Prophecy

One final reminder. Again, this is all connected. We’re lining up the dots.

Tonight, Mason Sexton walks investors through the momentous events due to appear in the markets over the next year.

Remember, this is the guy who predicted (and profited from) the bull market that led to the 1987 crash. He’s also the guy who predicted the ’87 top… to the day.

And two weeks before the market crashed, he told investors to sell and short sell – to profit from the falling market.

So far this year, Mason has timed the market’s ups and downs perfectly. Now, Mason would like you to join him tonight, at 8 p.m. E.T.

You can %%[IF (([isPaid] == true)) THEN]%%register here to hear his latest prediction%%[ELSE]%%register here to hear his latest prediction%%[ENDIF]%% when he announces it tonight.

Unconnected Dots

Our main task at The Daily Cut is to try to “connect the dots.” That is, we help you figure out what events are about, what makes them important, their consequences, and what it all means for you.

But sometimes, we see the individual “dots,” but can’t yet figure out how they connect to anything. Maybe they never will connect to anything.

Regardless, if those unconnected dots feel as though they could be important, we’ll mention them here. And we’ll let you draw your own conclusions.

Today’s unconnected dots…

-

Two articles from New York The first reports with the headline, “COVID Lockdowns Were a Giant Experiment. It Was a Failure.”

It goes on to say, “But it’s time to be clear about the fact that lockdowns for any purpose other than keeping hospitals from being overrun in the short-term were a mistake that should not be repeated.”

The second headline, “The Secrets of the JFK Assassination Archive: How a dogged journalist proved that the CIA lied about Oswald and Cuba – and spent decades covering it up.”

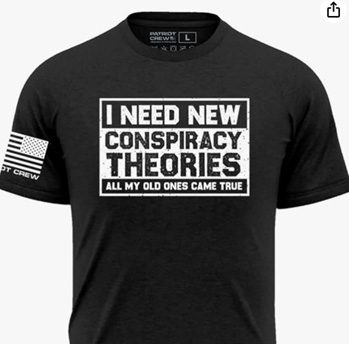

As soon as we saw those two headlines, we thought about a t-shirt we’ve seen advertised on Amazon from time to time:

Source: Amazon.com

We’ve placed our order. Extra-large! Delivery due in a week.

More Markets

Today’s top gaining ETFs…

-

SPDR Kensho Clean Power ETF +7.3%

-

Invesco S&P SmallCap Consumer Discretionary ETF +6.5%

-

iShares U.S. Home Construction ETF +6.2%

-

Pacer Benchmark Industrial Real Estate SCTR ETF +6.1%

-

SPDR S&P Homebuilders ETF +5.9%

Today’s biggest losing ETFs…

-

Global X MSCI China Energy ETF -0.2%

-

Direxion Auspice Broad Commodity Strategy ETF -0.2%

-

Invesco DB Commodity Index Tracking Fund -0.2%

-

Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF -0.1%

-

ClearShares Ultra-Short Maturity ETF 0%

Cheers,

|

Kris Sayce

Editor, The Daily Cut