This bull market isn’t over yet… This former Wall Street insider is all in… Keep an eye on these three growth sectors… In the mailbag: “Until the common folk understand this, nothing will change”…

That’s how long it’s been since the S&P 500 hit its post-crash low of 676 points on March 9, 2009, after plunging 57%.

Sure, there have been steep corrections along the way – in August 2015… and again in January 2016.

But if you take “bull market” to mean “long period of rising stock prices”… this is the longest on record.

Over that time, the S&P 500 is up 324%, or 415% including dividends.

That’s former Wall Street insider Jason Bodner, who heads up our Palm Beach Trader advisory.

As you’ll learn in today’s essay, he believes stocks won’t enter another bear market until we see a final “blow-off top” of frenzied buying.

It’s why Jason is fully invested in stocks for his personal accounts.

And it’s why he’s been telling his readers that one of the simplest ways to make money in the markets right now is to ride the U.S. stock market higher for even more explosive gains ahead.

Jason uses a proprietary “early detection system” to find quality stocks that are being pushed higher by unusually high levels of institutional buying.

In other words, buying from hedge funds, pension funds, and other large asset managers – aka the “smart money” – that’s way above average volume and outside of the usual price ranges.

And the results have been impressive. In the less than three months since it launched, Jason has given Palm Beach Trader subscribers the chance to make gains of 24%… 25%… 36%… 47%… and 59%.

And his average gain of the 10 stocks over that time is 23%. To put that in perspective, the average annual return for the S&P 500 has been 7.6% over the past 25 years.

But before he joined the Legacy team, Jason spent 14 years on Wall Street handling hundreds of billions of dollars in trades for deep-pocketed investors.

This gave him a ringside seat on the last two bull-bear market cycles:

-

The bear market that took the S&P 500 down 49% between March 2000 and October 2002… and the subsequent bull market that took the index up 101% until it peaked in October 2007…

-

The bear market that took the index down 57% to the next bottom in March 2009… and the current bull market that has taken the index 324 points higher since then.

And it’s left him convinced that we’re nowhere near the top of this bull market.

The first is sentiment.

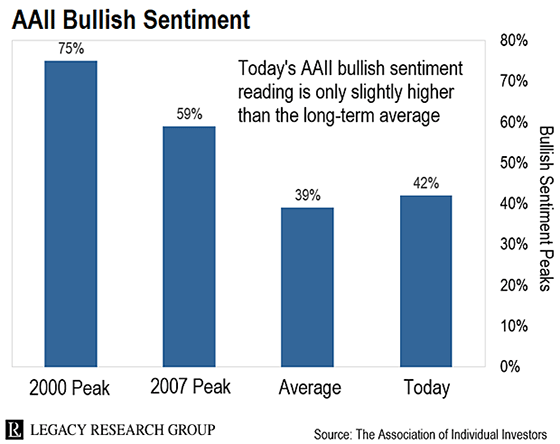

The American Association of Individual Investors (AAII) is a non-profit education organization for “mom and pop” investors. Since 1987, it’s asked its members the same question every week: “What direction do you feel the stock market is headed over the next six months?”

Right before the market collapsed in 2000, 75% of AAII members expected higher prices ahead. And again, on the eve of the 2007 financial crisis, 59% of AAII members were bullish about the market.

So, as you can see, the AAII sentiment gauge is a contrarian indicator. It turns strongly positive right before the market peaks… and then crashes.

That’s because the investors who make up AAII’s ranks are considered the “dumb money.” By the time they get excited about a bull market… the big gains are mostly gone.

This is in line with the long-term average bullish reading of 39%. And it’s nowhere near the extremes we’ve seen at previous market tops.

That’s why Jason says there’s lots more room to run. As he told us…

I studied the tulip bubble of the 1630s. I studied the internet bubble of the late 1990s. And I lived through the recent U.S. housing bubble. I was on the Wall Street trading desk to witness that one.

Here’s what I learned… When people are literally overlooking all the risk just to get a few extra percentage points of return, that will signal the end of a bull market.

At the top of a market, people are willing to step on their mothers’ necks to buy stocks. And we’re just not seeing that right now. Far from it. Today, a ton of people are fearful of stocks headed lower.

Simply put, there’s a lot to like about the U.S. economy right now. Jason…

We have record corporate sales… and earnings growth that just keeps continuing to beat expectations.

We have record low taxes. So companies are keeping more of their money, and consumers are keeping more of their money.

We also have companies using funds they would have paid out in taxes to pay special dividends and buy back their own stock. This is lifting the market higher.

Jason again…

Every day, I’m watching buying activity across different sectors, industries, industry groups, sub-industries. And the pattern I’ve been seeing recently is that consumer discretionary stocks, healthcare, and technology stocks have been overwhelmingly the ones getting bought up at unusually high volumes. I’m also seeing high-volume buying of riskier small-cap stocks.

These are all growth sectors right now. And that fits perfectly with my thesis that the bull market in stocks has a long way to run. The smart money is buying into growth. They’re not buying the defensive stocks. They’re buying Apple, and Google, and Amazon. They’re buying chipmaker Nvidia. They’re buying the Russell 2000 small-cap stocks.

When the smart money starts moving into more defensive sectors like utility stocks… that will be a sign that they’re getting more bearish.

Until that happens, Jason says there’s still plenty of upside left in U.S. stocks… and that you should stick with your positions – especially in the consumer discretionary, healthcare, and technology sectors.

Tomorrow, we’ll be taking a deeper dive into what could be the most profitable of all three – the tech sector… And we’ll talk to our resident tech investing expert, Jeff Brown, on how to identify “not evil” tech.

So make sure to look out for that in your inbox tomorrow.

In Monday’s Daily Cut, we asked you if there could ever be an exception to free speech.

And it’s yielded another hefty mailbag…

Free speech should remain as the Founders intended without any change. You do not have to accept what a person says, but that person has a right to express himself or herself.

– Robert K.

Make one exception to the rule and eventually everything can be excepted from the rule. The modern culture of political correctness is insulting in that it assumes that most people are too ignorant or too stupid to understand certain arguments and decide for themselves how to act.

– Joseph N.

I have always been an internal thinker, not an external speaker. I always think about what I’m going to say before I open my mouth. That way, I can keep from showing my ignorance and think about what effect my words will have on others. “Beautiful words are not always truthful and truthful words are not always beautiful.”

– James B.

Keep it free as intended. To do otherwise is to limit this freedom which inevitably leads to other rights being infringed upon, which is already happening. We need to get back to educating our society about what freedom is and what it takes to remain free.

– Robert F.

Free speech is free speech, with no restraints. Whether it offends you or not, any restraint takes away the word “free.“

A larger concern is the not-so-Supreme Court ruling that unaccountable super PAC money is free speech. Add in the fact that a corporation has every right of a citizen, except the right to go to jail for illegal activity. Until the common folk understand that campaign contributions are cash bribes for favors, nothing will change.

– Bernie B.

I disagree that we need to limit any speech… even the yelling of “fire” where none exists. The Constitution does not say that only truthful speech is protected, all speech is. Should “fire” lead to people being trampled to death, the speaker would be executed after a just trial. Knowing such negates the need for a prohibition.

– Kendrick M.

Is there any exception to free speech that you’d tolerate? As always, let us know at [email protected]…

Regards,

|

Chris Lowe

September 12, 2018

Barcelona, Spain

P.S. Next month at the Legacy Investment Summit in Bermuda, Jason will lead a breakout session dedicated to his bullish case for U.S. stocks. He’ll also show you how to pick stocks with explosive potential, no matter what the market’s doing.

Jason will also be giving away his top five “outlier stocks” that you should own in your portfolio today.