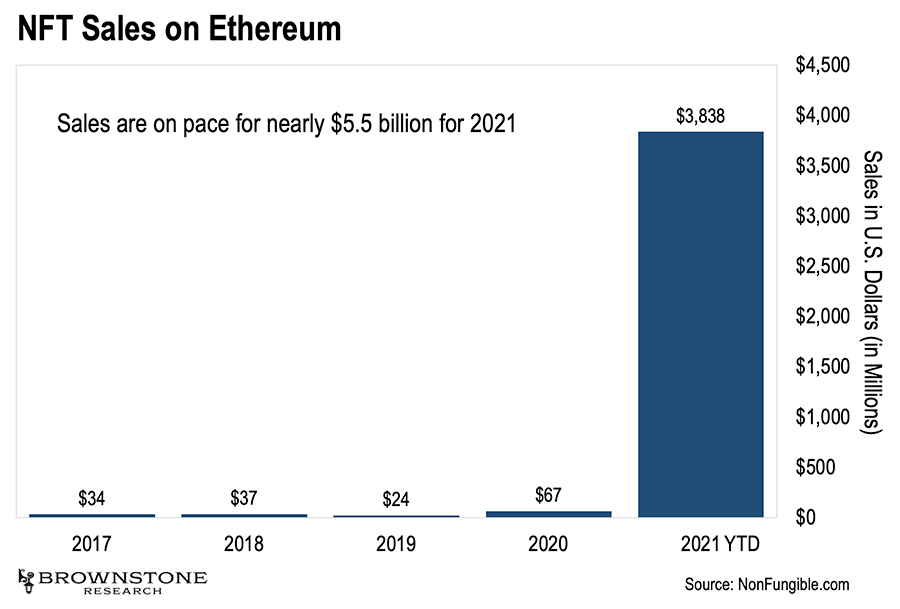

In 2020, this market was worth $67 million.

And from the start of this year to the end of August, it was worth $4 billion.

That’s a gain of more than 5,000%.

I’m talking about NFTs, or non-fungible tokens.

And according to our tech expert, Jeff Brown, they’re one of the most explosive profit opportunities in the world right now.

| Recommended Link | |||

|

|||

| — |

What are NFTs?

Why is this market exploding right now?

It’s all in your Weekly Pulse video at the top of the page.

It’s where I (Chris Lowe) and host Tom Beal break down the most important market story on our radar for the week.

Regards,

Chris Lowe

Editor, The Daily Cut and Legacy Inner Circle

| Click here to access the Legacy Inner Circle archive |

| Not yet a Legacy Inner Circle member? Join here. |

Transcript

Tom Beal: What if you were able to get into a time machine and go speak to yourself 10 years ago and say, “Buy Bitcoin. Trust me, this is going to be a huge trend in the upcoming 10 years”?

Well, we’re not telling you that we have a time machine. But we are bringing awareness to you of a trend that many of our experts within Legacy Research Group are saying is the next trend of the decade.

That’s what we do here at The Weekly Pulse. My name is Tom Beal, host of The Weekly Pulse, where we bring to you the biggest wealth-growth story of the week. I’m here today with the editor of Legacy Inner Circle, Chris Lowe. Chris, how do we kick off today’s conversation?

Chris Lowe: Today, Tom, I want to talk about what I think is going to be the biggest trend of the next decade, and maybe even the next century. I know that sounds like a very big claim, but I’m getting it from a good source. It’s Jeff Brown, our tech investing expert.

What Jeff has been talking about lately, which has really fascinated me, is something called tokenization. I know that sounds a bit jargony. So just picture a world where you can buy your stocks, your bonds, your options, your cryptocurrencies, even stakes in pieces of art, collectibles, real estate, just about everything through the same exchange, 24/7. That’s tokenization.

It starts with these things called NFTs [non-fungible tokens]. You hear about them a lot in the news right now, in relation to the art world. But it ends with every financial asset, everything you own, being tokenized.

So today, I thought we’d just do three simple things…

We’ll talk a little bit about what’s going on with NFTs, the beginning of the tokenization trend.

Then I’ll show you why this is already a big trend in motion… and a big investment trend.

And then, we’ll talk a bit about where this is all going and where Jeff sees this ending up.

Tom: For the listeners here and viewers of The Weekly Pulse, if that word frightens you – tokenization, or NFTs, or any of this other verbiage – don’t let that stop you from hearing what Chris is going to share with you, but also Jeff Brown, the Legacy Research expert who is at the forefront of these new technologies.

That’s really what this is all about. In protecting and growing your wealth, when you can get ahead of “where the puck is going,” that allows you to have first-mover advantage, in many cases.

So with Jeff’s insights, that Chris is bringing to us here, this may be unfamiliar to you, whether it’s the terms that are used, whether it’s the actual diving deeper, but it’s to put it on your radar. Because when experts like Jeff bring it to our attention, it’s something we may want to pay close attention to. It can be one of those big gainers for us in the near future.

So I just wanted to set that preface, Chris, because I know I’m unfamiliar with a lot of these terms. I’m sure many of the Weekly Pulse viewers are as well. Don’t let it frighten you. This is now putting it on the radar to say, “Hmm, maybe I’ll take a closer look at this and follow some of the insights that Chris and Jeff Brown bring to us.”

Chris: Tom, you’re absolutely right. Folks shouldn’t be put off by the acronyms or the jargon around NFTs. NFTs are tokenized pieces of art. They’re art that lives on the blockchain, if you like. The blockchain is the distributed ledger technology that underpins crypto.

I’m not going to get too far into the weeds, Tom. Basically, what’s happening is that artists are minting these tokenized versions of their art and selling them. And it’s a booming business.

I looked at some figures of NFT sales on the Ethereum blockchain (that’s the second-most-valuable blockchain in the world, after bitcoin). Last year, NFT sales were about $67 million. Already this year, they’ve topped $4 billion. And they’re on track to complete this year upwards of $5.5 billion.

That’s the kind of money that is flowing into these tokenized pieces of art right now. That’s a more than 5000% increase in sales of NFTs this year over last year. We can put a chart up of that from Jeff.

So that’s a very quick introduction, Tom. NFTs are tokenized pieces of art. They live on the blockchain. And sales are absolutely booming.

Tom: And what you’re saying now is that tokenization is part one of what’s to come, where pretty much everything will be tokenized. Is that a fair statement or summary?

Chris: That’s exactly right, Tom. You’ve probably seen something that a lot of people out in the mainstream haven’t seen.

I’ve been looking into NFTs for quite a while now, and I’ve written about it in The Daily Cut. And of course, I’ve been reading what Jeff Brown has been putting out… and also, what Teeka Tiwari, our other crypto expert here at Legacy Research Group, has been putting out.

I’ll be honest with you, some of this stuff blows my mind. And I’m a little bit skeptical of it. As you’ve probably heard, there was an NFT piece of digital art sold in March for $69 million. It was by a guy I’ve never heard of called Beeple. His real name is Mike Winkelmann. I’ve never heard of him. But I do know – because I looked it up – that $69 million is roughly what one of the most sought-after Picasso paintings sold for in 2018.

So we’ve got digital artwork as an NFT from this guy called Beeple selling for the same price as a Picasso. It really baffles the mind.

But what you said is absolutely right, Tom, that art is only the beginning of the tokenization trend. That’s why it’s so interesting to Jeff. That’s why he’s spending so much time on this with his readers.

Right now, as investors, we can invest in stocks. We go to a broker for that. We can invest in bonds. We can do that through a broker, too. Or we can go to a crypto exchange and buy some cryptos.

And then there are some things that are very hard to invest in, like real estate, collectibles, vintage cars. These are the playground of the ultra-wealthy. If you’ve got a lot of money, you can go out and buy a vintage Ferrari. But if you’re an everyday investor, that’s hard.

With tokenization, all of that changes. Just as you can have a tokenized version of a piece of art, you can have a tokenized version of a vintage Ferrari. You can buy a fractional stake in that. You can have a tokenized version of a Kentucky Derby racehorse, and you can have a fractional stake in that. You could tokenize shares in commercial real estate and have a stake in that.

That is why this is such a big deal. It basically allows us to take stakes in just about anything, all through what Jeff calls a GTE, or global token engine. I won’t go into the details of how these things work, but they’re to do with blockchain and crypto.

They allow us to take real objects, create these digital representations, and then trade them back and forward – just like we do with our cryptocurrencies, we send them to people through a digital wallet on our smartphone.

Tom: My mind’s trying to wrap my understanding of this. On my desk, I have a receipt from the store Publix. It sounds like tokenization is almost like a receipt. You said you can own parts of certain things, physical or digital.

So when we think of automobiles – you mentioned the Ferrari example – there’s a title transfer, right? You purchase it from the person who owns it. They transfer the title to you. Now, you own the title. It takes a little bit of time to get that all squared away.

Tokenization, if I’m following correctly, is almost like a receipt, like a title that you now have proof, “Hey, I own a stake in this particular asset,” whether it’s digital or physical.

Am I following it along nicely? Or am I missing something?

Chris: You are following it along nicely. And you’re helping me out today, because this is a complicated topic. I’ve been thinking about this myself, trying to get my head around it. But that’s exactly right. These NFTs, or non-fungible tokens, are a little bit like receipts for a unique item. That’s where the non-fungible part comes in. Non-fungible means unique.

So they are like digital receipts for a unique item, like a racehorse. No two racehorses are the same. Like a vintage Ferrari. These things are almost unique. They won’t be in the same condition, the same year. So just like a collector looks at those rare artifacts and rare collectibles, that’s what you can do with NFTs and tokenization.

You can take stakes in those things – fractional stakes. You don’t have to buy the whole vintage Ferrari. You don’t have to buy the whole racehorse. Let’s face it, a lot of us just aren’t going to be able to do that.

The world that Jeff sees coming is a world in which we will be able to take stakes in virtually anything. It’ll blow wide open what we consider to be the investing world.

We’re not just going to be in a stock exchange. It’s not just going to be cryptos. It’s going to be real-world items, collectibles, art, real estate… as well as those financial items, cryptos, bonds, stocks, options… all in the same wrapper, all in your wallet on your smartphone, along with a range of other things. You’ll be able to spend in the shops using that. You may have your ID, your driver’s license in that wallet as a token.

So this is really big. You’re probably going to own the deeds to your house that way, too.

This is in its very early stages. A lot of the mainstream press is focused on some of those crazy prices for NFT art. I totally get that.

But this – as Jeff has been showing his readers, and as I’ve been trying to figure out from following along with what Jeff has been talking about – is much bigger than that.

Tom: It’s starting to make sense to me. I hope it’s making sense for the other viewers here at The Weekly Pulse. Years ago, I studied NCR. NCR is National Cash Register. In the early 1900s, they invented receipts. And they invented the cash register and had to go around selling to stores, saying, “Look, you’re going to give your patrons a receipt of ownership that they’ve purchased something from you.”

That was a huge industry that started in the early 1900s. The way you just described this to me, I see this is where it’s all shifting. It takes, like you said, the titles and the deeds and the things like driver’s licenses and all this, and it’s all through the blockchain. And that is, from my understanding, not manipulatable. That’s a key, right? It’s not going to be hacked, where hackers can come in and take your ownership. That’s the other solid part of this.

I’m now getting why you mentioned in the beginning how this is not just the biggest trend for the next 10 years, but possibly the next 100 years. This now takes the NCR, National Cash Register Company, that most of us probably never heard about. I didn’t hear about it until I studied it years ago. This is the new version of it for the digital age, using this new blockchain technology.

I can now see why you said that bold statement, “This is going to be a huge trend.” And now, I see why Jeff is so excited about this, as are other experts inside the Legacy Research Group.

Chris: Yeah, Tom. And I think you mentioned there that you can’t hack a blockchain. They’re tamper-proof. That is a really key point. Why would you want all these receipts for different things on a blockchain unless that was a superior technology?

And it is superior. You can’t tamper with records once they’re placed on a blockchain. That’s because they’re cryptographically secured. And most importantly, they’re decentralized.

These days, you have deeds in a central registry that could be manipulated, hacked, or stolen. That becomes impossible on a blockchain. You’re absolutely right to point that out.

I love the analogy of the NCR. I never heard of that myself. It is something similar.

We’re going to enter this world in which we can do all these things, invest in all these new assets that are just really hard to do at the moment. And all on the same platform, and all digital, all seamlessly moving around. We can trade them, swap them, send them. It’s fascinating.

If people want to think about how to invest in this trend, one idea is just to buy Ether (ETH), which is the token associated with the Ethereum blockchain. I mentioned that there was about $4 billion worth of sales this year of NFTs on Ethereum. The reason I pulled up that chart is that Ethereum is the main blockchain so far, right now, where NFTs live. So that’s one way to pick up some exposure.

And of course, Jeff and Teeka will be talking to their paying subscribers about more detailed ways to do that. But a very easy first step would be to buy some Ether. Folks probably already have Ether, but that is one blockchain that’s poised to benefit from the NFT and tokenization explosion we’re about to see.

Tom: Wow. Thank you for bringing this to my and the Weekly Pulse viewers’ attention. I now picture this like how many years ago, when you brought bitcoin to people’s attention, that was way ahead of the curve. Even the people who didn’t take action right away, who waited a little while, they were still able to see some ridiculously large gains.

I see this as being way ahead of the curve also. Hence why Jeff Brown, Teeka Tiwari, and other experts inside Legacy Research Group are bringing it to their reader’s attention. They see it as having huge potential in the near future. So thanks for bringing it to our awareness.

And as Chris mentioned, there are some things you can do to take action now. But stay tuned… there’s more to come from Chris, Jeff Brown, Teeka Tiwari, and the other experts here at Legacy Research Group.

Thanks for bringing it to our attention, Chris, here at The Weekly Pulse.

Chris: Thanks, Tom.

| Not yet a Legacy Inner Circle member? Join here. |